Retirement Planning Fundamentals Explained

Wiki Article

What Does Retirement Planning Do?

Table of ContentsWhat Does Retirement Planning Do?How Retirement Planning can Save You Time, Stress, and Money.The Best Strategy To Use For Retirement PlanningFascination About Retirement PlanningThe Definitive Guide for Retirement PlanningThe Retirement Planning PDFs

A 401(k) suit is likewise a much more cost-effective method to provide a monetary reward to your staff members, as your organization will certainly be paying much less in payroll taxes than if you used a typical raise or incentive, and the employee will additionally obtain even more of the money since they will not need to pay supplementary earnings tax - retirement planning.1. 5% may not appear like much, however simply an interest substances, so do costs. This cash is instantly subtracted from your account, so you may not instantly see that you could be conserving hundreds of bucks by moving your assets to a low-priced index fund, or changing suppliers to one with lower financial investment charges.

If you have certain retired life accounts where you can contribute with funds with taxes you have actually paid currently vs. paying taxes upon the withdrawal of the funds in retirement, you may desire to believe concerning what would certainly conserve you extra in tax settlements over time. If you have certain much shorter term financial investment accounts, assume about how much cash you would certainly spend there (and subsequently pay tax obligations on in the near future) vs.

Listen to this: Before we prior to discussing begin reviewing plan for a successful retirementEffective we need to understand what is retirement planning and preparation and also it important?

However, our team believe that rather than feeling the pinch post-retirement, it's sensible to begin conserving early. What you just need to do is to begin with an achievable saving, strategy your investments and with a long-term dedication. The method you wish to spend your retirement entirely depend upon the amount of money you have actually saved and spent.

The Best Guide To Retirement Planning

Fulfilling their heavy medical costs and various other requirements together with personal household requirement is really extremely difficult in today's age of high rising cost of living. retirement planning. Thus, it is advisable to begin with your retirement financial savings as very early as you are two decades old as well as solitary. The senior citizens posture a huge worry on their family that had actually not planned and also saved for their retirement.There's constantly a health and wellness concern connected with growing age. There may be a circumstance where you can not function any longer and the cost savings for retirement will certainly help to guarantee that you are well cared of. So the large inquiry is that can you manage the price of long-term care since it can be really expensive and is consisted of in the cost of your retirement.

Do you intend to keep functioning after your retired life? If the answer is no, after that you should start with your cost savings. Individuals who are unprepared for retirement often have to maintain functioning to accomplish their family members's need throughout life. It is very not likely that you will certainly generate income forever, thus, financial savings play an essential function.

Getting My Retirement Planning To Work

Related Site

If you start late, it may take place that you have to compromise or readjust yourself with your pre-retirement look what i found and retired life lifestyle. The quantity that you require to save and include each duration will certainly depend upon just how early you start saving. Beginning with your retirement planning in the twenties might appear prematurely for your retired life.

Starting early will enable you to establish great retired life savings as well as planning routines and give you even more time to rectify any type of blunder as well as to identify any type of shortfall in accomplishing your goal - retirement planning.: Catch up on your Retirement Planning in your 50s The retirement should be made and also executed as quickly as you start functioning.

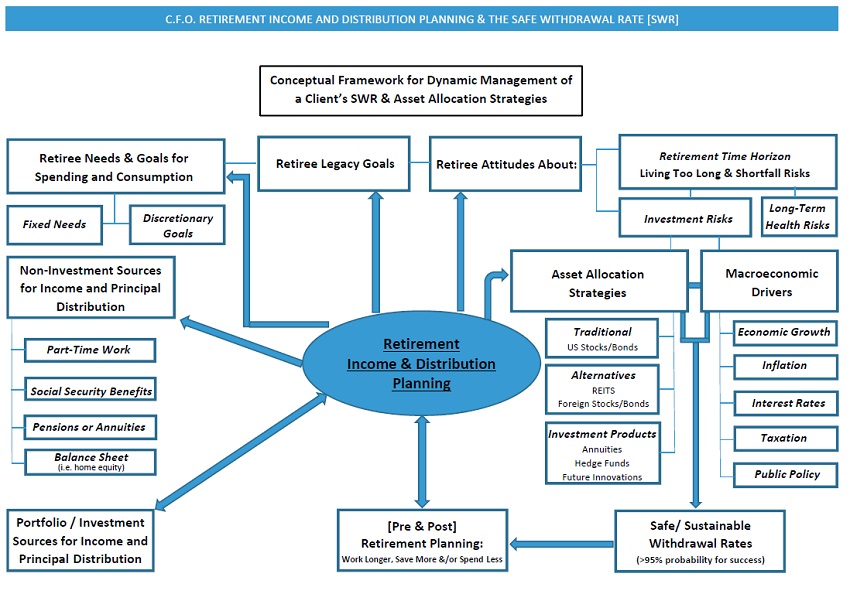

These economic planners will consider numerous factors to execute retired life evaluation which includes your income, expenses, age, wanted retired life way of living and also so on. Hence, use the sweat of your golden years to give a shade in your old days so that you leave the world with the sensation of satisfaction as well as efficiency.

The Buzz on Retirement Planning

There is a common false impression amongst young workers, and it often sounds something like, "I have lots of time to prepare for retirement. If you wait for the "ideal" or "best" time, you'll never begin.

With these two ideas in mind, staff members can be encouraged to plan for retirement instantly. Neither their age neither their existing finances must come in the means of retired life planning.

The 20-Second Trick For Retirement Planning

Several of us postpone occasionally also the most productive people, apparently! When it comes to conserving for retirement, putting things off is not recommended.For instance, based on information from the Office for National Statistics they had 6,444 of non reusable earnings per head in 1977. In 1982, they had 7,435 of non reusable revenue per head. go to my blog By 1987, they had 8,565 These pairs are all the very same age The key difference in between them is, they really did not all begin to conserve for their retirements at exactly the exact same time.

They made a decision to save 175 per month (2,100 per year). 29 percent of their annual revenue. They got inexpensive mutual funds, placing 70 percent of their money in supplies, 30 percent in bonds.

Report this wiki page